Are you looking to go beyond with Bitcoin Loophole and diversify your cryptocurrency trading portfolio? You may want to consider adding some altcoins—alternative cryptocurrencies such as Ethereum, Ripple, Litecoin, and more. This article will explain the basics of altcoins and provide tips on how to start trading them.

What Are Altcoins?

Altcoins are alternative cryptocurrencies that were created after the success of Bitcoin. They often have different technical aspects than Bitcoin but share similar characteristics such as decentralized control, peer-to-peer transactions, and immutable records. The number of altcoins is growing every day as new projects launch their own coins to raise funds or create a new platform for users.

Benefits Of Investing In Altcoins

The primary benefit of investing in altcoins is diversification. By spreading out your investments across multiple assets, you can reduce your risk by avoiding putting all your eggs in one basket. Additionally, many altcoins have lower prices than those found on major exchanges like Coinbase or Gemini, allowing investors who may not be able to allow high-priced coins to get involved in the market. Finally, there are a wide variety of altcoins available so traders can find coins that align with their investment goals or interests.

Tips For Beginners

Before getting started with trading altcoins, it’s important that beginners understand the risks involved with volatile assets such as cryptocurrencies. Investors should also do some research on potential projects before investing money into them in order to make sure they understand what they’re buying into and familiarize themselves with the technology behind each coin. It’s also important to remember that most altcoin investments are long-term plays so patience is key when waiting for a return on investment (ROI).

Choosing An Exchange

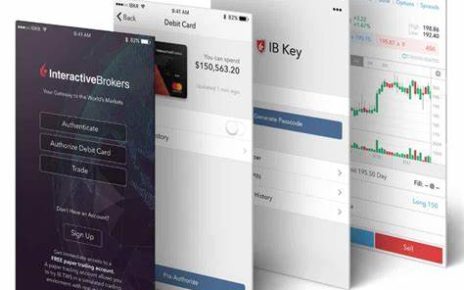

Once you have decided which coins to invest in and done your due diligence on each project, it’s time to choose an exchange where you can buy and sell these coins. When choosing an exchange, it’s important that traders look at factors such as fees, payment options accepted, security measures taken by the platform, customer support offered by staff members if needed, and geographic restrictions placed on certain countries from accessing certain features or services offered by the exchange itself.

Finding Professional Advice

Due to the complexity of cryptocurrencies, it’s recommended that newcomers seek professional advice before investing a significant amount in digital assets such as altcoins. As this space continues to evolve rapidly, traders need access to accurate information quickly, which can be difficult for individual investors who don’t have experience reading white papers or understanding complex concepts related to blockchain technology or cryptography algorithms used by various coins. Professionals who specialize in this area are familiar with all aspects of cryptocurrency markets, making them valuable resources when seeking advice on which assets may offer better returns than others over time based on current market conditions.

Bottom line

Investing in cryptocurrencies can be a great way for both novice and experienced traders looking for ways to diversify their portfolios without the limited exposure to stocks or bonds available through traditional financial institutions. By exploring alternative digital assets, known as ‘altcoins’, investors can gain access to a much wider range of opportunities while still mitigating their risk, as most investments are longer-term plays. However, it’s highly recommended that before anyone starts investing large sums in these emerging asset classes, they first properly educate themselves on the industry trends and regulatory requirements associated with specific products, and seek professional guidance if necessary. With proper planning & preparation, any investor could potentially open up a whole new world of opportunities not available through traditional channels!